GOBankingRates' editorial team is committed to bringing you unbiased reviews and information. We use data-driven methodologies to evaluate financial products and services - our reviews and ratings are not influenced by advertisers. You can read more about our editorial guidelines and our products and services review methodology.

20 Years

Helping You Live Richer

Reviewed

by Experts

Trusted by

Millions of Readers

It’s helpful to know how to find your checking account routing number. You may need it for several reasons, including signing up for direct deposit, transferring funds to an account at another bank or linking your checking account to a payment app. If you’re a Chase customer or are transferring money to a Chase account, refer to the following chart for a list of every Chase routing number.

| State | Chase Routing Number |

|---|---|

| Arizona | 122100024 |

| California | 322271627 |

| Colorado | 102001017 |

| Connecticut | 021100361 |

| Florida | 267084131 |

| Georgia | 061092387 |

| Idaho | 123271978 |

| Illinois | 071000013 |

| Indiana | 074000010 |

| Kentucky | 083000137 |

| Louisiana | 065400137 |

| Michigan | 072000326 |

| Nevada | 322271627 |

| New Jersey | 021202337 |

| New York — Downstate | 021000021 |

| New York — Upstate | 022300173 |

| Ohio | 044000037 |

| Oklahoma | 103000648 |

| Oregon | 325070760 |

| Texas | 111000614 |

| Utah | 124001545 |

| Washington | 325070760 |

| West Virginia | 051900366 |

| Wisconsin | 075000019 |

Use the table above to find your state and ABA routing number for Chase. Make sure the routing number matches your checks and account.

A routing number, also known as an American Bankers Association or ABA number, comprises nine digits telling financial institutions where transactions need to be processed. Suppose you deposit a check at an ATM. The routing number lets the bank identify the financial institution from which the check was drawn.

Many banks have only one routing number, but because Chase is so big, it has multiple routing numbers across the U.S. If you’re a Chase customer, your routing number depends on where you opened your account. For instance, if your Chase routing number is 322271627, you opened your account in California. However, if you opened your account any other state, you have a different routing number. So, as a Chase customer, it’s essential always to verify you’re using the correct routing number.

The first four numbers of the routing number are Federal Reserve Bank identifiers. The next four numbers in the sequence identify your bank. These numbers are assigned, just like your checking account number. The last digit in a routing number is the check digit, which is calculated from an algorithm and validates the eight-digit bank routing number’s authenticity.

For example, the routing number 322271627 is for Chase accounts opened in California. The second set of four digits in the routing number — 7162 — identifies the bank.

There are a few different ways to find a Chase routing number:

Get the latest news on investing, money, and more with our free newsletter.

By subscribing, you agree to our Terms of Use and Privacy Policy. Unsubscribe at any time.

You're now subscribed to our newsletter. Check your inbox for more details.

If you are at all confused about which number to use, you should consider calling Chase. Using the right number could mean the difference between your money going into the right or wrong account.

Several types of financial transactions might require you to supply your routing number, including:

To complete an international wire transfer, you’ll use a SWIFT code instead of a routing number. The SWIFT code is an international bank code that identifies financial institutions worldwide. You’ll need to give this code to anyone who wants to send money to you from overseas or get the code for a recipient’s bank if you’re the sender.

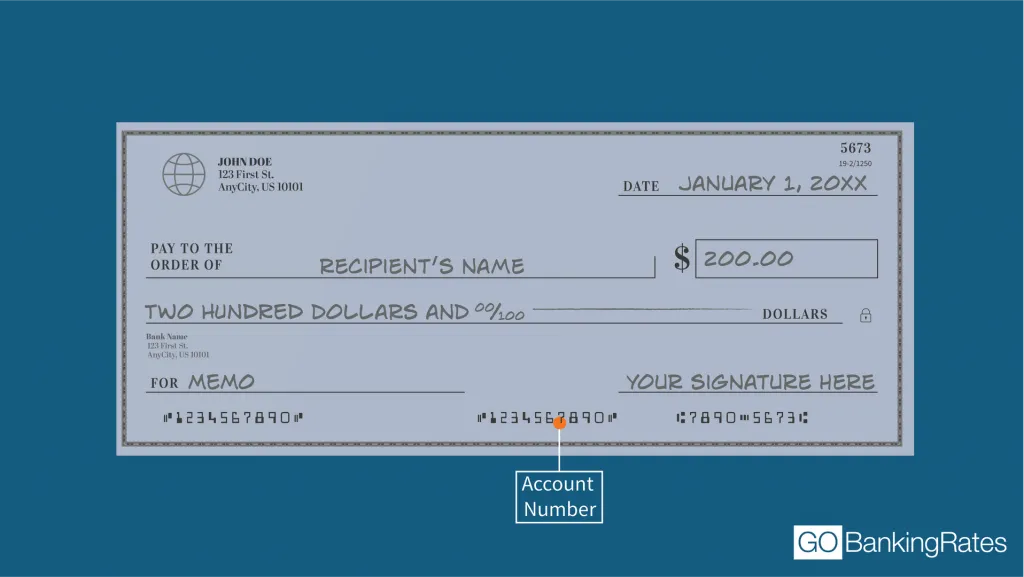

In addition to using the SWIFT code, you must supply specific information to your bank whenever someone is wiring money to you from another country. This information includes your account number, shown in the following example, and your name as it appears on the account.

When you’re transferring money to someone internationally, the recipient will also need to know their bank routing number to receive the money. If you’re making or receiving a domestic wire transfer, there’s a specific transfer number for that as well.

Here are Chase’s wire transfer numbers and SWIFT code.

| Transfer Type | Number |

|---|---|

| Domestic Wire Transfer | 021000021 |

| International Wire Transfer | 021000021 |

| SWIFT Code | CHASUS33 |

No one wants their money to end up in the wrong account or to get delayed when a payment due date is looming. Account numbers and routing numbers are required to complete banking transactions expediently and accurately. Anytime you need to supply your Chase routing number and account number to set up a transaction, verify you’re using the correct numbers and that you’ve entered them correctly. Even though routing numbers are public information, you should only give your account and routing number to trusted parties.

Ryanne Mena and Erika Giovanetti contributed to the reporting of this article.

Information is accurate as of Jan. 5, 2024.

Editorial Note: This content is not provided by Chase. Any opinions, analyses, reviews, ratings or recommendations expressed in this article are those of the author alone and have not been reviewed, approved or otherwise endorsed by Chase.

View SourcesOur in-house research team and on-site financial experts work together to create content that’s accurate, impartial, and up to date. We fact-check every single statistic, quote and fact using trusted primary resources to make sure the information we provide is correct. You can learn more about GOBankingRates’ processes and standards in our editorial policy.